Contents:

There is some controversy as to whether the body of the engulfing bar must completely engulf the previous candle. While some of you might already be familiar with the contents of this post, for others it will offer an entirely new perspective.

Trade ideas thread – European session 6 March 2023 – ForexLive

Trade ideas thread – European session 6 March 2023.

Posted: Mon, 06 Mar 2023 07:00:00 GMT [source]

For example, if a price is trading at higher highs and higher lows, this indicates that it’s on an upward trend. If it’s trading at lower highs and lows, it’s trending downwards. Traders can use their knowledge of the sequence of highs and lows to choose an entry point at the lower end of an upward trend, and by setting a stop just before the previous higher low.

Trendline Trading

Before that I was lost in a world of unprofitable trading robots and unnecessary indicators. Price action trading is better suited for short-to-medium term limited profit trades, instead of long term investments. This consists of three candles in a specific sequence — a bearish candle, a candle with a lower high and a higher low, and a bullish candle. The third candle must have a higher low, and it should close above the second candle’s high. A line found on a candlestick chart which is used to indicate where the price of an asset is fluctuating in…

- A scalping strategy aims to trade in the trend direction and enter during a pullback when the price starts moving back in the trending direction.

- This is maybe one of the most misunderstood price action secrets.

- The fundamental belief of price action analysis is that price is never wrong.

After a breakout extends further in the breakout direction for a bar or two or three, the market will often retrace in the opposite direction in a pull-back, i.e. the market pulls back against the direction of the breakout. A viable breakout will not pull-back past the former point of Support or Resistance that was broken through. Otherwise if the market adheres to the two attempts rule, then the safest entry back into the trend will be the H2 or L2.

Price action strategy: a complete guide for traders

It has a long history of use, with many traders getting decades worth of results from it across a range of different markets . Price is king but what does it take to trade price action successfully and why do so many traders struggle with it? The charts show the same market and the same period and both are 4H time frames. They used different closing times for their candles and, thus, the charts look slightly different.

FX option expiries for 7 March 10am New York cut – ForexLive

FX option expiries for 7 March 10am New York cut.

Posted: Tue, 07 Mar 2023 07:48:00 GMT [source]

Whereas Neutral patterns, such as symmetrical triangles, can form in any market and while they signal that a big move is about to happen, they do not provide a directional cue. The Fibonacci retracement is drawn on a chart from a low to a high , or a high to low . In a strong trend, pullbacks are typically shallow, often only reaching the 38.2% level.

Trend channel line overshoot

It is incorrect to assume price action works the same on all timeframes. The lower the timeframe the less effective the signal is because of noise. If a signal takes a day to form it has more weight behind it, if a signal takes 5 minutes to form is has much less weight behind it.

Since many traders place protective stop orders to exit from positions that go wrong, all the stop orders placed by trapped traders will provide the orders that boost the market in the direction that the more patient traders bet on. The phrase “the stops were run” refers to the execution of these stop orders. Since 2009, the use of the term “trapped traders” has grown in popularity and is now a generic term used by price actions traders and applied in different markets – stocks, futures, forex, commodities, cryptocurrencies, etc. All trapped trader strategies are essentially variations of Brooks pioneering work. Most price action authors state that a simple setup on its own is rarely enough to signal a trade. There should be strength in the direction of the trade that a trader is thinking of taking and at least two reasons to enter the trade.

The 100% goes at the bottom of the move and the 0% at the top because price is rising. Your job as a trader is to manage this risk and close the trade. Discover the range of markets and learn how they work – with IG Academy’s online course. I am really happy for this information because its now that i became aware that i was lost by other traders. Patience is the key to making Forex price action work for you. Always remember that the quality of the setups you take is far more important than the frequency.

A https://g-markets.net/ action trader generally sets great store in human fallibility and the tendency for traders in the market to behave as a crowd. For instance, a trader who is bullish about a certain stock might observe that this stock is moving in a range from $20 to $30, but that trader expects the stock to rise to at least $50. Many other traders would simply buy the stock, but then every time that it fell to the low of its trading range, would become disheartened and lose faith in their prediction and sell.

We can observe this phenomenon when the rejections from a resistance become increasingly weaker and the price can return to the resistance level more quickly in each case. Formations such as triangles or the Cup and Handle are based on the concept of order absorption as well. A breakout might not lead to the end of the preceding market behaviour, and what starts as a pull-back can develop into a breakout failure, i.e. the market could return into its old pattern. The simple entry technique involves placing the entry order 1 tick above the H or 1 tick below the L and waiting for it to be executed as the next bar develops. If so, this is the entry bar, and the H or L was the signal bar, and the protective stop is placed 1 tick under an H or 1 tick above an L. A pull-back is a move where the market interrupts the prevailing trend, or retraces from a breakout, but does not retrace beyond the start of the trend or the beginning of the breakout.

Is trading price action profitable?

Is price action trading profitable? Like any trading strategy or tool, profitability depends on how it is employed. Many successful investors and traders have all shown that trading price action trading can be profitable.

A pull-back which does carry on further to the beginning of the trend or the breakout would instead become a reversal or a breakout failure. With-trend legs contain ‘pushes’, a large with-trend bar or series of large with-trend bars. Trend bars are often referred to for short as bull bars or bear bars. A trading range where the market turns around at the ceiling and the floor to stay within an explicit price band.

- This may sound simple, but as we have already seen during the candlestick analysis, we can quickly acquire comprehensive knowledge when we break down complex facts into its single components.

- The trader sets a floor and ceiling for a particular stock price based on the assumption of low volatility and no breakouts.

- Bodies that close near the top often signal bullish pressure.

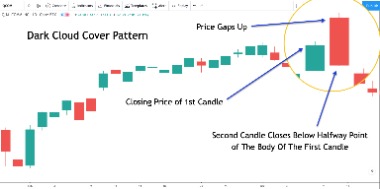

- Price action candlestick patterns serve as key signals or triggers for traders, helping them predict future price movements.

You can practice these how to trade price action in forex analysis skills by registering for a demo account and trading with virtual funds, and when you are ready, you can switch to a live account to trade with real funds. It is advisable to focus on one strategy at a time and aim to learn it inside out. One solid strategy, traded well, has the potential to be highly profitable.

This detailed price information can tell a price action trader a lot about the collective action of market participants. The positioning of HLOC price points determines the size and shape of the candle as well as the information it provides to a price action trader. For this reason, some candle types provide bullish signals such as hammer; bearish signals such as hanging man; and neutral signals such as Doji. You can learn more about the different types of candlesticks in our comprehensive candlestick patterns guide. This gives price action traders more price information as candlestick patterns form on the chart. As noted above, individuals primarily trading based on price do not consider the fundamental factors as the support and resistance levels indicate consolidation and breakout.

Which indicator is best for price action?

The most commonly used price bars which are used as a price action indicator, are called candlesticks. All trading platforms in the world offer candlestick charting – proving just how popular price action trading is.

What Does Price Action Tell You?

Technical analysts look to price action on charts to look for patterns or indicators that can help predict how a security will behave in the future and to time entry and exit points of trades. Technical tools like moving averages and oscillators are derived from price action and projected into the future to inform traders.